Boozman Releases New Batch of Trades Amidst Possible Ban

July 2024 saw a new step forward in the era of banning Congress trading when on July 10, a bipartisan group of senators initiated a fresh attempt to prohibit members of Congress from trading stocks.

One of the most vocal candidates for opposing Congressional trading, Sen. Josh Hawley said, “There is no reason why members of Congress ought to be profiting off of the information that only they get.”

This proposal marks the latest effort in Congress's long-running attempt to regulate lawmakers' stock trading activities. It is the first proposal to be formally reviewed by a Senate committee, specifically the Homeland Security & Governmental Affairs Committee, on July 24.

On the other hand, most trading activities by Congress members are ongoing.

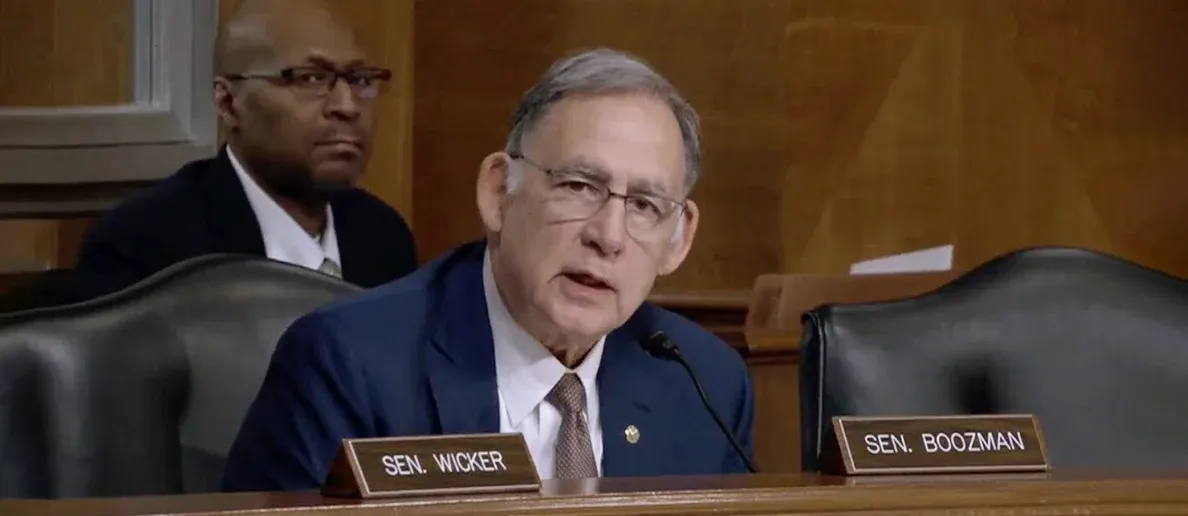

Most recently, Sen. John Boozman reported five trades: three purchases and two sales. On July 18 and 26 respectively, he sold SPDR MidCap 400 ETF Trust (MDY:US) and Lam Research Corp (LRCX:US) in value ranges of $1,001 to $15,000. Notably, LRCX stock has seen a startling price decline of 13.91% since the Senator’s sale.

On July 18, he also sold the ETF, Vanguard FTSE Developed Markets ETF (VEA:US), in values ranging between $1,001 and $15,000. The Vanguard ETF tracks the performance of the FTSE Developed All Cap ex-US Index, which includes a broad range of large, mid, and small-cap companies in Canada and major markets in Europe and the Pacific region. He later stocked up on Motorola Solutions Inc (MSI:US) and Alphabet Inc (GOOGL:US) on July 26, 2024.

If the bill above is enacted, it would also ban lawmakers' spouses and dependent children from trading stocks, starting in March 2027. Additionally, from that year onward, the U.S. president, vice president, and all members of Congress would be required to divest from any specified investments.