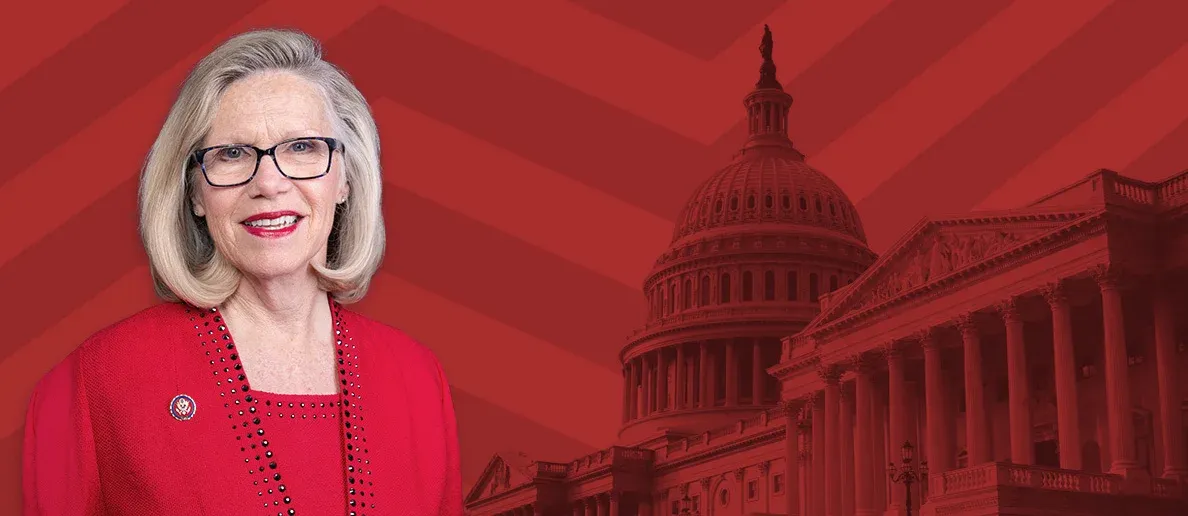

Carol Miller Is Buying Stocks Despite Recession Risks

Carol Miller, the U.S. representative for West Virginia's 3rd congressional district since 2019, disclosed earlier this week a bunch of new trades which have increased her exposure to the U.S. market, according to stock watchers.

Rep. Miller was buying single stocks and ETFs in November, according to this past week's disclosure. The Congresswoman invested between $50,000 - $100,000 in each of the Fidelity Mid Cap Index Fund (FSMDX:US) and iShares MSCI EAFE ETF (EFA:US) on November 14.

While FSMDX is focused on the U.S. mid-caps, EFA offers exposure to large- and mid-capitalization developed market equities. Both trade higher this week relative to Miller’s entry price.

Reported in the past week, the Congresswoman invested between $15,000 - $50,000 in each Vanguard Growth ETF (VUG:US) and Vanguard Whitehall Funds High Dividend Yield (VYM:US) in November. As far as single stocks are concerned, Rep. Miller was buying shares of Target Corp (TGT:US) and Texas Instruments (TXN:US).

This way, Rep. Miller joined other Congress members in betting that the stock market could recover after challenging times in 2022. U.S. House Representatives like Kurt Schrader and Ro Khanna increased their exposure to the U.S. stock market in recent weeks.

Miller, who sits on the House Committee for Climate Crisis, is not known as a regular stock market trader. She mostly trades stocks and ETFs that belong to defensive sectors, like Healthcare and Consumer Staples.