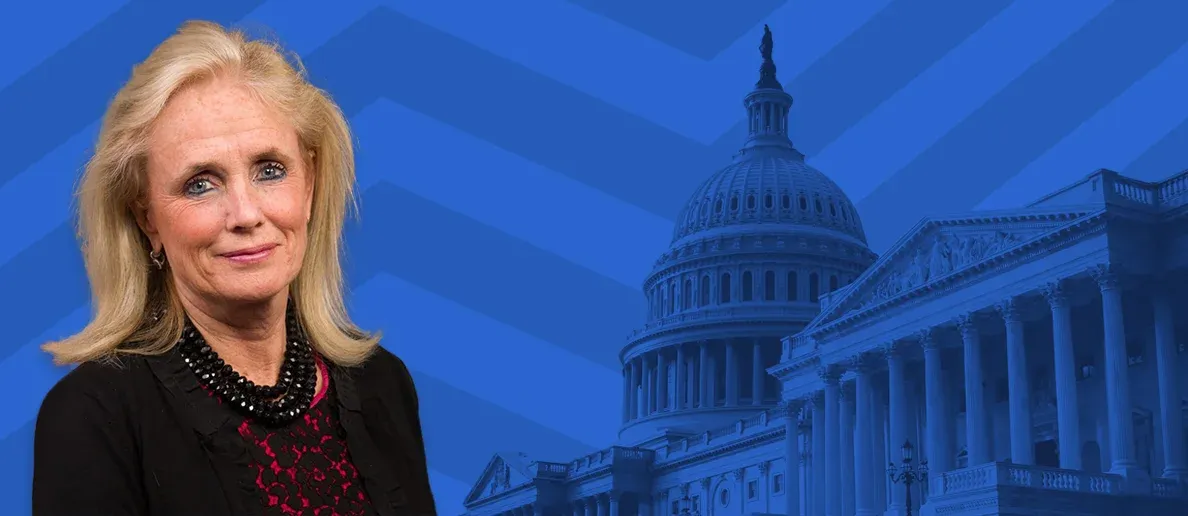

Debbie Dingell Buys Blackstone Group Stock

Debbie Dingell is a member of the Democrat party, representing Michigan’s 6th congressional district. On 20th April 2023, she disclosed a buy transaction of Blackstone Group Inc (BX:US) worth $15,000 - $50,000. The transaction was carried out on 10th April 2023.

Blackstone announced its Q1 earnings on 20th April 2023. On the face of it, the earnings didn’t look promising. Its EPS declined 37% QoQ, primarily due to recent redemptions and outflows, as well as the general slowdown in Real Estate activity in the US, a segment that Blackstone relies on for half of its earnings.

Representative Debbie Dingell’s transaction has come just before an announcement by Blackstone that it is considering helping regional banks with lending. Just for some perspective, Blackstone is among the world’s biggest ‘non-bank’ lenders. If these talks succeed, they could open a new revenue stream for the company, allowing it to grow despite the Real Estate headwinds. Debbie Dingell will be comfortably placed to reap the benefits of such a deal if it materializes.

Blackstone President Jonathan Gray did not disclose which banks the firm was in talks with. But he was confident about the benefits of this new opportunity.

“As regional banks experienced outflows of deposits, we are seeing real-time opportunities to partner with them at scale. The regional banks generally play a very large role in home improvement loans, auto loans, and equipment finance. Those are all areas of opportunities... We're in a number of discussions” he said on the company’s Q1 earnings call.

Blackstone is also about to hit the $1 trillion mark for its assets under management. This means investors continue to trust them, bringing in more fee-related profits for the company.

Apart from Debbie Dingell, Republican representative Rep. Michael Burgess also carried out two buy transactions in the stock on February 24, 2023, both valued between $15,000 - $50,000 each. If the Real Estate market picks up pace, and Blackstone succeeds in becoming a lender for the struggling regional banks, it could have multiple tailwinds that can potentially send its stock skyrocketing.