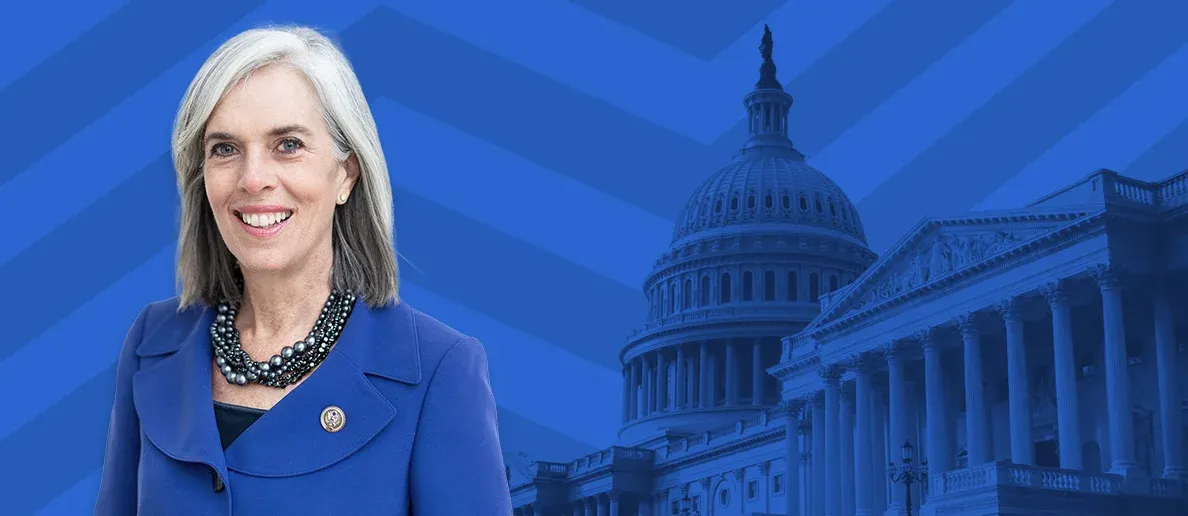

Katherine Clark’s Bet on This Solar Stock Is Paying Off

Despite a market rout in 2022, the solar sector did extremely well. Solar stocks soared mid-year after the U.S. adopted the Inflation Reduction Act (IRA), which represents a significant investment by the federal government in renewable energy.

Some solar stocks, like First Solar (FSLR:US), doubled in value and perhaps even more in just a couple of months. First Solar stock gained almost 200% from July to November after analysts highlighted the company as one of the biggest beneficiaries of IRA given that it is known to be the largest US-based panel manufacturer.

In November, the company announced it will build its fourth U.S. panel factory, selecting the state of Alabama for its $1 billion-plus investment. CEO Mark Widmar said that the passage of the IRA was a key catalyst for First Solar to keep investing in more supply.

“The passage of the Inflation Reduction Act of 2022 has firmly placed America on the path to a sustainable energy future,” First Solar’s Widmar said in a statement.

“This facility, along with its sister factories in Ohio, will form part of the industrial foundation that helps ensure this transition is powered by American innovation and ingenuity,” he added.

In late October, First Solar announced its third-quarter results, with revenue rising by $8 million quarter-over-quarter to reach $629 million. The company also reported a $68 million operating loss.

Looking at Congress members’ trades, one can see that Congresswoman Katherine Clark has been buying FSLR shares since 2020. Clark, the U.S. Representative for Massachusetts's 5th congressional district since 2013, had invested in First Solar in both 2020 and 2021 while shares were trading below $90 per share.

First Solar stock price closed at $156.80 on Friday, January 06.