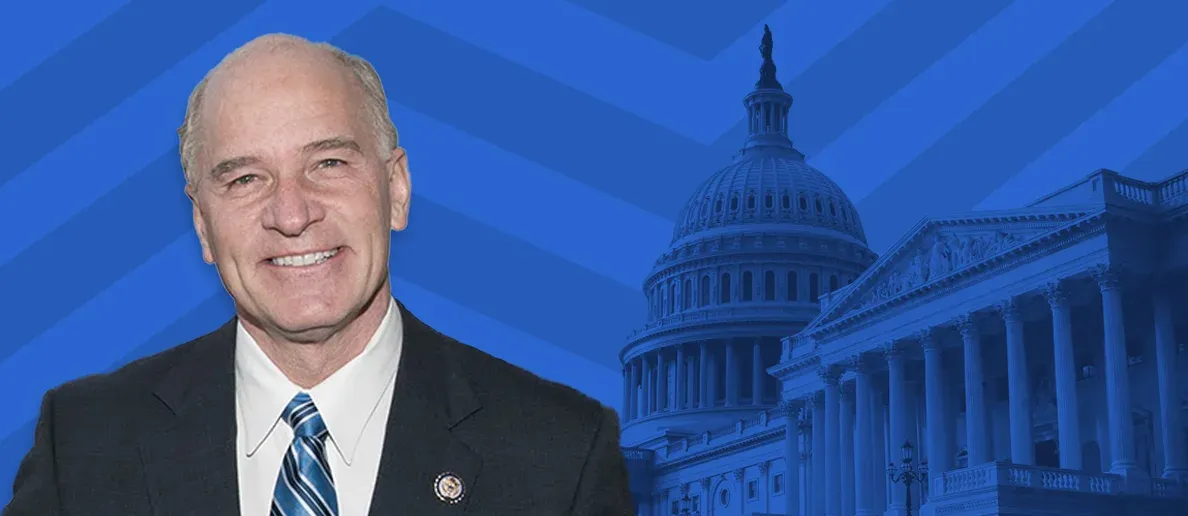

Rep. Bill Keating Allocates More Money Towards U.S. Treasuries

Congressman Bill Keating disclosed today that he was making another bond trade in October after having already invested in some U.S. treasuries in May and July, respectively.

Serving as the U.S. representative for Massachusetts's 9th congressional district since 2013, Congressman Keating bought between $50k and $100k worth of shares of The iShares iBonds Dec 2024 Term Treasury ETF (IBTE:US) that seeks to track the investment results of an index composed of U.S. Treasury bonds maturing in 2024. He reported this trade 28 days after the transaction date on October 7, 2022. Unlike his past three trades, he did not report late this time.

The most recent bond trade represents Rep. Keating’s largest trade in 2022 so far. He made two other trades in US Treasuries: One between $15k and $50k worth of US Treasury Notes in July and the other where the Notes were valued between $1k and $15k in May. From the looks of it, he appears to be placing his bets for an upcoming turnaround in US Treasuries by the end of 2024.

As a member of the Armed Services and Foreign Affairs committees, Congressman Keating usually trades Tech shares, followed by Financials, Healthcare, and Consumer Discretionary. U.S Treasuries are unusual. Congressman Keating tends to trade smaller sizes, judging from the 80 trades he reported in the last 3 years.