This Senator Bought Cathie Wood’s ETF ARKK Prior to a 15% Decline

Cathie Wood, the prominent investor and the founder, CEO, and CIO of Ark Invest caught the media spotlight earlier this week after she wrote a new letter to the Federal Reserve.

Wood, whose tech-heavy Ark Innovation ETF (ARKK) is down almost 80% from its 2021 peak, accused the central bank of raising interest rates too fast.

“Without question, food and energy prices are important, but we do not believe that the Fed should be fighting and exacerbating the global pain associated with a supply shock to agriculture and energy commodities caused by Russia’s invasion of Ukraine,” Wood said in a letter.

Tech stocks are trading significantly lower this year after the red-hot inflation prompted the Fed to raise interest rates at a rapid pace.

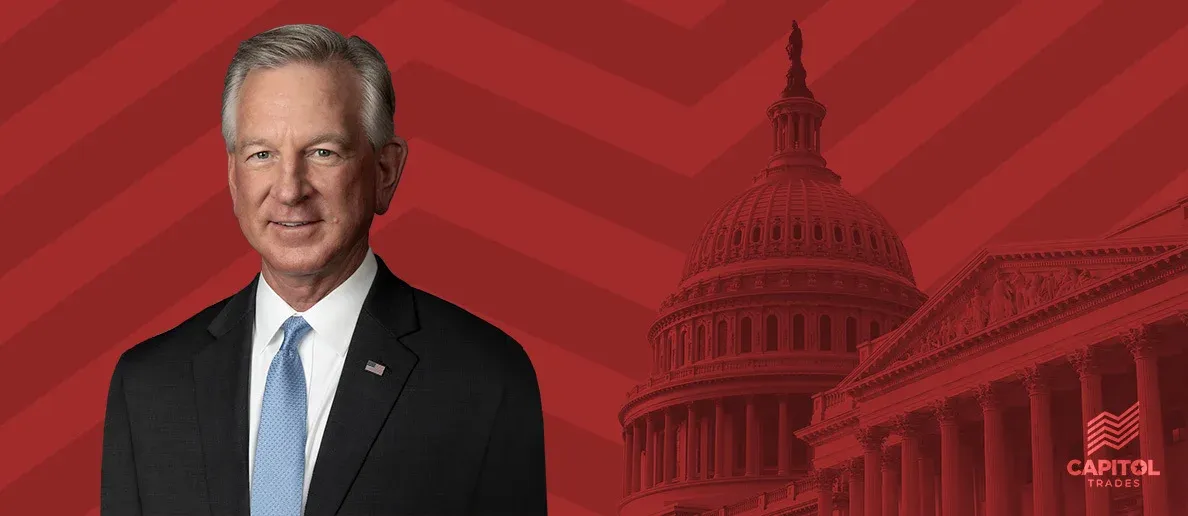

It now seems that Wood has some fans within the Senate after a Republican from Alabama, Tommy Tuberville, disclosed he invested in ARKK on two different occasions in September.

On September 07, Senator Tuberville invested between $50,000 and $100,000 in ARKK, before adding another $1,000 - $15,000 on September 19. Senator Tuberville was buying ARKK when the market was in the low $40s. The ETF closed at $36.04 yesterday.

The Senator also bought Microsoft (MSFT: US) shares, once for $250,000 - $500,000 when MSFT closed at $244.52 before selling a small portion a day later. Shares trade around $10 lower relative to Tuberville’s purchase price.

The Senator also invested $100,000 - $250,000 in US Steel (X: US), filings show. Elsewhere, Mr. Tuberville sold between $500,000 and $1 million worth of ChannelAdvisor (ECOM: US) shares. He also reported trades involving Ford Motor (F: US) shares.

Mr. Tuberville is one of the most active Senate traders with almost 500 trades reported since he became representative last year. ECOM, X, as well as PayPal are his favorite stocks for trading in terms of volume.