Micron Posts Best Day in a Year As Samsung Cuts DRAM Output

Shares of Micron Technology (MU:US) rose 8% on Monday to record their best day since March last year, after memory rival Samsung announced it plans to cut its output significantly in response to weakening demand.

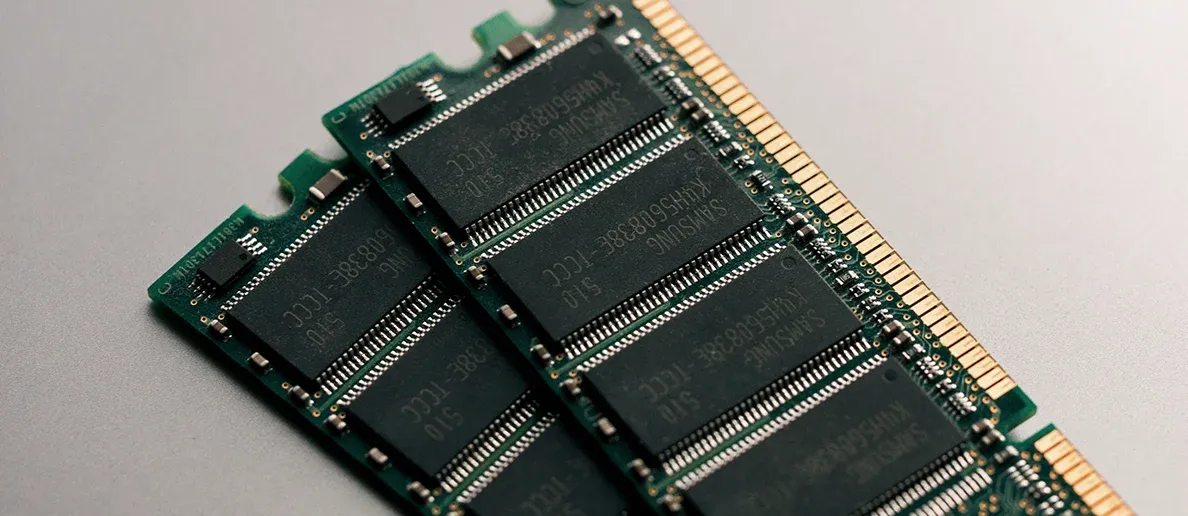

Such a move is likely to support a recovery in prices for DRAM memory chips given the falling supply.

Analysts said the move would support a recovery in prices for DRAM memory chips. Earlier, smaller memory market participants announced output cuts as the sector fights a massive global downturn in demand as well as plunging prices.

"[Samsung’s] production cut signal casts a positive outlook for a memory chip rebound in the second half of the year,” John Park, an analyst at Daishin Securities, told Reuters.

It seems that Samsung, the largest memory maker in the world, was forced to implement radical measures and support the industry as it said it expects its Q1 profit to fall by 96% year-over-year.

Despite the warning, Samsung shares rallied on the memory output cut update.

"We are lowering the production of memory chips by a meaningful level, especially that of products with supply secured," Samsung said.

Last September, Micron said it would slash its 2023 investment plans by over 30%.

Shares of the company fell roughly 50% in 2022 as the company fights a massive memory market downturn. The stock is now working to print new 8-month highs as it tests the resistance around $65 a share.

Congressman Ro Khanna was trading the Micron stock in recent months as investors look to position themselves ahead of a potential bottom in the memory market downturn.