NVIDIA’s Earnings Run Could Rub Off on Other US Stocks

This year may mark another record year for AI computing company, NVIDIA Corp (NVDA:US). With a share price surge of almost 90%, Nvidia hit the spot for the third-largest U.S. company by market value. On May 2, the company announced that they would be hosting a conference call on Wednesday, May 22, to disclose its first fiscal 2025 quarterly results.

The expectations were high since Robust earnings from Nvidia could elevate other tech stocks and support the lofty valuations in the stock market. The S&P 500 is presently valued well above its historical average.

In its first quarter of fiscal 2025 earnings, Nvidia reported a rise in quarterly revenues by 18% quarter-on-quarter and a whopping 262% year-on-year. Furthermore, the company finalized a ten-for-one forward stock split effective from June 7, 2024.

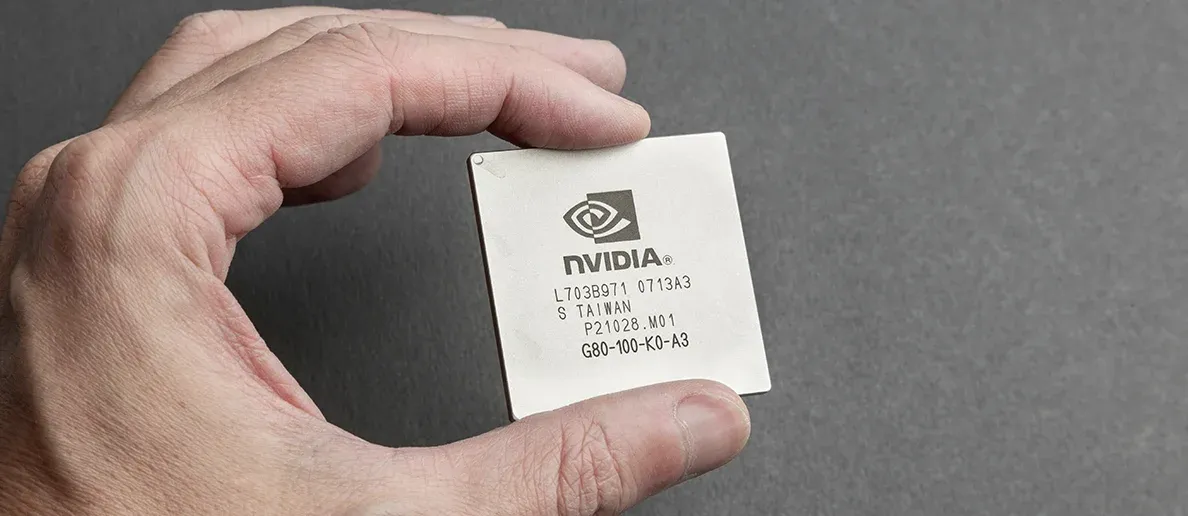

Nvidia’s CEO Jensen Tuang attributed this success to the company’s Blackwell chips. Sales of the chips were rising with the demand for computing power required by generative AI. Huang emphasized that Blackwell would usher in a new growth phase for Nvidia and mentioned that the company plans to continue producing newer, more powerful chips annually.

On the Congressional side, around 29 lawmakers have reportedly traded in NVDA stock as of yet.

Most recently, Rep. Pete Sessions sold up to $100,000 worth of NVDA shares on May 21; just a day before the earnings release. Senator Tommy Tuberville sold up to $50,000 of NVDA shares on April 30. Before this, Representatives Ro Khanna and Dan Newhouse sold between $1,001 and $15,000 each. Rep. Khanna also bought Nvidia shares under his Child’s name on March 01.